Created 9 months ago

The Royal Mousse Milk Tea scam was a sophisticated Ponzi scheme disguised as an online milk tea franchise, targeting investors with promises of daily high returns and referral rewards.

Royal Mousse Milk Tea Scam - The Ruthless Deception Uncovered

The Royal Mousse Milk Tea scam is one of the most outrageous and malicious frauds in recent times, a vicious financial trap masked as a harmless investment opportunity. This sinister scheme operated under the veil of a franchise model, pretending to be a milk tea business offering lucrative returns, but behind the curtain lay a predatory Ponzi setup designed solely to exploit gullible individuals desperate for financial growth. With promises of insane profits and daily income streams, this scam mercilessly drained the wallets of countless innocent investors who believed they were partnering with a legitimate enterprise.

The Bait: Outrageous Promises and Deliberate Lies

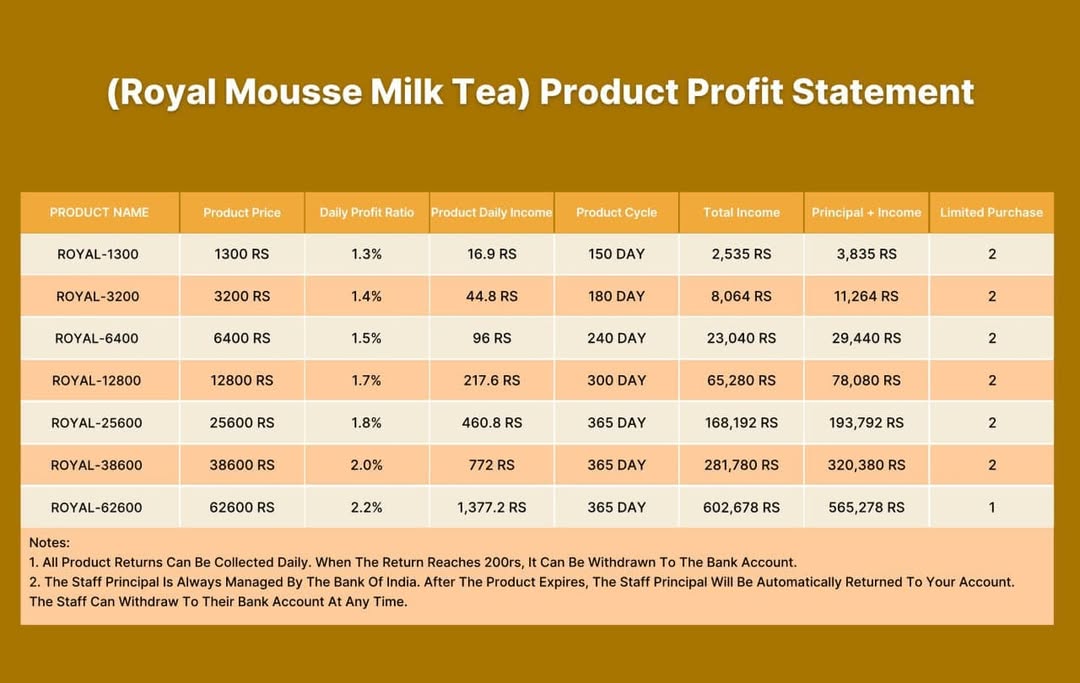

The masterminds behind this operation meticulously crafted a narrative that preyed on hope and urgency. They enticed people with unbelievably high daily returns, claiming that an investment of as little as ₹1,000 would yield ₹20 daily for six whole months. This translated to a jaw-dropping 720% return annually, a figure not even the most profitable businesses in the world can legally and sustainably deliver. This was not ambition—it was deception. Such unrealistic promises should have rung alarm bells instantly, but the scammers were skilled at manipulation, using psychological tactics to drown out common sense with visions of effortless wealth.

The Trap: Referral Schemes and Pyramid Tactics

Once an investor was hooked, the platform pushed them to recruit others, offering extra bonuses and commissions for every new person who joined under their name. This is textbook pyramid scheme behavior. The foundation of the scam was not a product or a service—it was the constant flow of new money from new victims. The entire structure was built like a house of cards, where one layer supported the next, and the moment new users stopped joining, the collapse was inevitable. What makes this even more disgusting is how it turned victims into unwilling accomplices, urging them to drag their friends and families into the abyss unknowingly.

The Illusion: Fake Platforms and Controlled Payouts

To mask their intentions, the fraudsters built a sleek-looking website and mobile application to simulate legitimacy. The app even appeared on the Google Play Store, boasting over 100,000 downloads. This public presence gave users a false sense of security, as they assumed such platforms would have been vetted and monitored. In the beginning, the scammers allowed small withdrawals to lull investors into a false sense of trust. These controlled payouts were nothing more than breadcrumbs meant to bait the victims into reinvesting even more money. This was not generosity—it was calculated deceit designed to build confidence before the kill.

The Switch: Sudden Restrictions and Unjustified Fees

As soon as a significant number of people had invested substantial sums, the tone changed. Withdrawal requests began to fail or were postponed indefinitely. New rules were introduced arbitrarily. In a stunning act of financial cruelty, the platform slapped users with a 99.99% withdrawal fee if they attempted to access their funds before a specified lock-in period. This wasn’t a policy—it was a robbery. People who had trusted the platform with their hard-earned savings suddenly found themselves trapped in a digital prison, watching their investments evaporate with no recourse or explanation.

The Cover-Up: Fake Apologies and Fabricated Management

Once the scam became too big to contain, and backlash started growing, the perpetrators released a shamelessly fake apology letter. They conjured up a non-existent CEO, claimed unforeseen circumstances, and told users that their money would be locked for three years. This move was not only cowardly but downright insulting. After robbing people blind, they dared to ask for more time under the false promise of a return. This wasn’t crisis management—it was another layer of deceit, carefully worded to delay legal consequences and pacify enraged victims long enough for the scammers to disappear.

The Red Flags: Obvious Signs of Fraud Ignored

There were numerous glaring warning signs that were unfortunately ignored by many due to the promise of quick riches. The company had no registered physical office, no verifiable business records, and no transparency regarding ownership or leadership. The domain of the official website was recently registered, with redacted ownership details, and held an abysmal trust score on scam monitoring sites. It was evident that this was a digital mirage, a ghost operation hiding behind anonymity. There were no products, no supply chains, no business activity—just flashy dashboards and manipulated numbers crafted to mislead and ensnare.

The Fallout: Financial Devastation and Emotional Trauma

Victims of this monstrous scam suffered devastating losses. Many poured their life savings into this fraudulent platform, encouraged by initial returns and the slick marketing. Some individuals lost upwards of ₹2 lakh, and in many cases, entire families were affected. This wasn’t just about money—it was about broken trust, emotional ruin, and the shattering of hopes. People believed they were building a better future, only to watch it be snatched away in the blink of an eye by heartless criminals with no remorse.

The Platform’s Disappearance and Silent Exit

As outrage mounted and more people began reporting issues, the platform began removing traces of its presence. The mobile app disappeared from the Play Store, social media pages went inactive, and websites became unreachable. This was the final act of cowardice, a silent exit that left behind a digital wasteland filled with unanswered questions and unrecovered losses. The scam artists vanished into the shadows with the victims' money, leaving law enforcement and regulators scrambling to make sense of the chaos.

The Dark Reality of Online Investment Frauds

The Royal Mousse Milk Tea scam is a brutal reminder of how digital platforms can be weaponized for mass deception. In an age where anyone can design a professional-looking app and fabricate fake testimonials, the line between genuine opportunity and financial entrapment becomes dangerously blurred. The fraudsters used modern tools to execute an ancient crime—stealing under the guise of business. The level of sophistication in their operations shows this was not a random hustle; it was a premeditated, deeply structured con job with a clear objective: extract as much money as possible before vanishing without a trace.

The Urgent Need for Awareness and Vigilance

Scams like this thrive on ignorance, desperation, and misplaced trust. The Royal Mousse Milk Tea platform didn’t just take money—it took advantage of people’s dreams and turned them into nightmares. It played on financial struggles, offering a quick fix that ultimately led to long-term suffering. The world must recognize these predators for what they are: digital wolves cloaked in opportunity. We must learn to scrutinize, to question, and to protect ourselves and our communities from falling into similar traps. Only through awareness, education, and collective vigilance can we hope to stop these vile schemes from spreading further and ruining more lives.