Created 1 month ago

The new income tax regime brings significant changes to tax slabs and rates, offering substantial relief to middle-class taxpayers. Under this revised structure, no income tax is payable on income up to ₹12 lakh, with an extended limit of ₹12.75 lakh for salaried individuals due to a standard deduction of ₹75,000.

New Tax Regime Proposal

No Income Tax up to ₹12 Lakh

- No income tax is payable on income up to ₹12 lakh (excluding special rate income like capital gains).

- For salaried taxpayers, the limit increases to ₹12.75 lakh due to a standard deduction of ₹75,000.

- Slab and rate changes benefit all taxpayers, reducing the tax burden on the middle class and increasing household consumption, savings, and investment.

Revised Tax Rate Structure

| Income Range (₹) | Tax Rate (%) |

|---|---|

| 0 – 4 lakh | Nil |

| 4 – 8 lakh | 5% |

| 8 – 12 lakh | 10% |

| 12 – 16 lakh | 15% |

| 16 – 20 lakh | 20% |

| 20 – 24 lakh | 25% |

| Above 24 lakh | 30% |

Tax Rebate & Benefits

Illustration of Tax Benefits

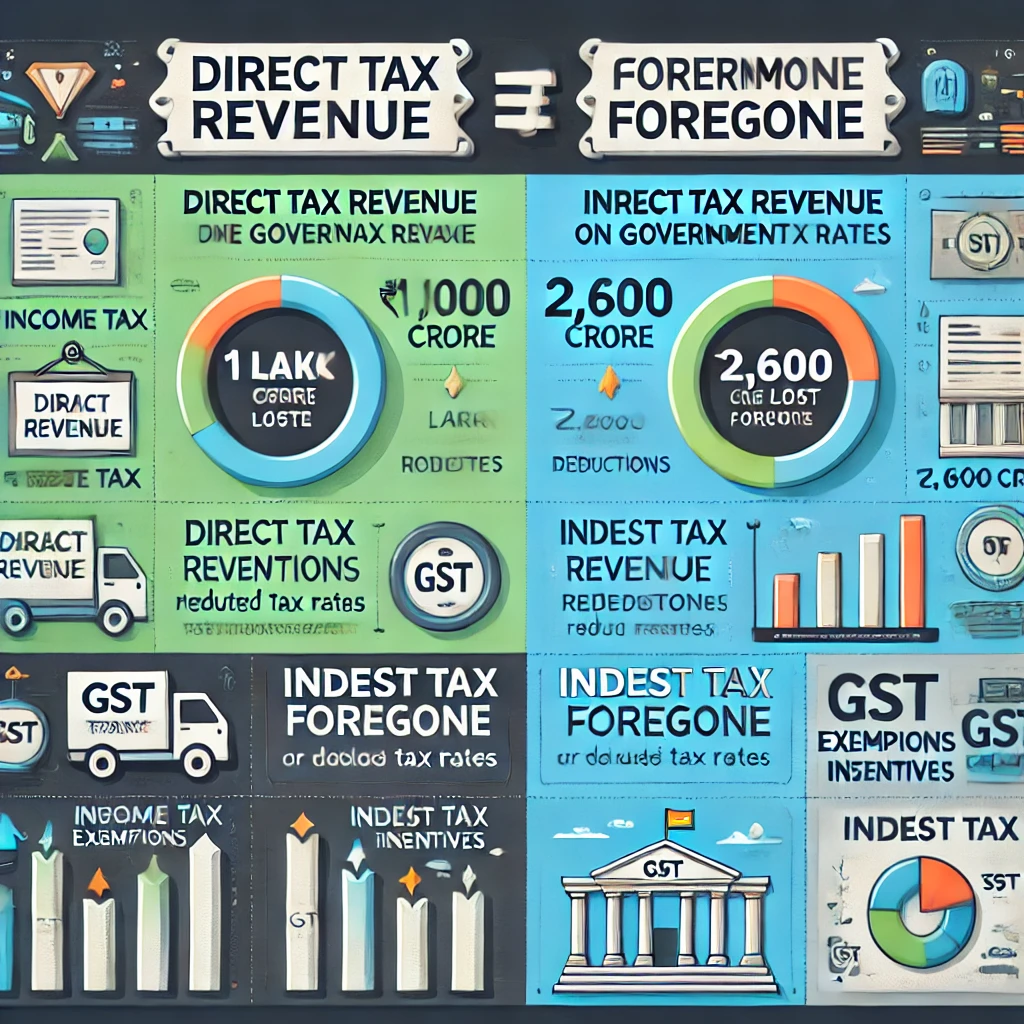

Impact on Government Revenue

Direct Tax Revenue Foregone: ₹1 Lakh Crore

This refers to the amount of revenue that the government would have collected from direct taxes, such as income tax or corporate tax, but was not collected due to exemptions, deductions, or reductions in tax rates.

Indirect Tax Revenue Foregone: ₹2,600 Crore

This refers to the revenue lost from indirect taxes, such as Goods and Services Tax (GST) or customs duties, due to exemptions, lower tax rates, or other incentives.